Diving into OpenAI's financials - how do they actually make money?

OpenAI is on track to hit $2bn revenue milestone as growth rockets, joining Google and Meta as fastest-growing tech companies ever.

Founded in 2015 as a non-profit AI research lab, OpenAI underwent a significant transformation into a commercial powerhouse when it established a business arm in 2020.

According to The Information, a technology publication, as of October last year, OpenAI's annualized revenue reached $1.3 billion. Notably, the pace of sales growth has persisted and continued to accelerate. The company is currently on track to hit $2bn revenue milestone as growth rockets, joining Google and Meta as fastest-growing tech companies ever.

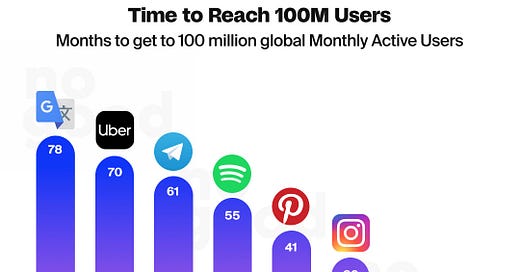

According to Altman, 92 per cent of Fortune 500 companies were using OpenAI products, including ChatGPT and its underlying AI model GPT-4, as of November last year, while the chatbot has 100mn weekly users. But how exactly is OpenAI hitting those numbers? Let’s look into it.

The OpenAI business model

OpenAI combines cutting-edge AI research with commercial applications of AI technology. The company’s business model is designed to advance the field of artificial intelligence safely and make the technology available to various businesses at affordable prices.

As a research organization, OpenAI has developed varieties of technologies and tools in the field of artificial intelligence. Some notable examples of those technologies are GPT-3, DALL-E, and OpenAI Codex. The company’s focus on research is one of the significant factors that makes its business model unique. But does this actually make money?

As a company, OpenAI has been generating money from licensing since the time it transitioned to a for-profit organization in 2019. OpenAI licenses its language models to businesses and organizations that require them to create virtual assistants, chatbots, and other applications.

On top of that, while most OpenAI resources can be used for free, a few of its resources, especially the advanced ones require subscriptions, which generate high volumes of income, especially through B2B clients.

Their cutting-edge technology places the company ahead of its competitors. It is one of the significant reasons OpenAI is an attractive company to most businesses seeking AI solutions and why it has attracted so many investors who are willing to pour huge amounts of money into it for a minority stake in the company, confident that their projected valuation will offset any doubts they might have today.

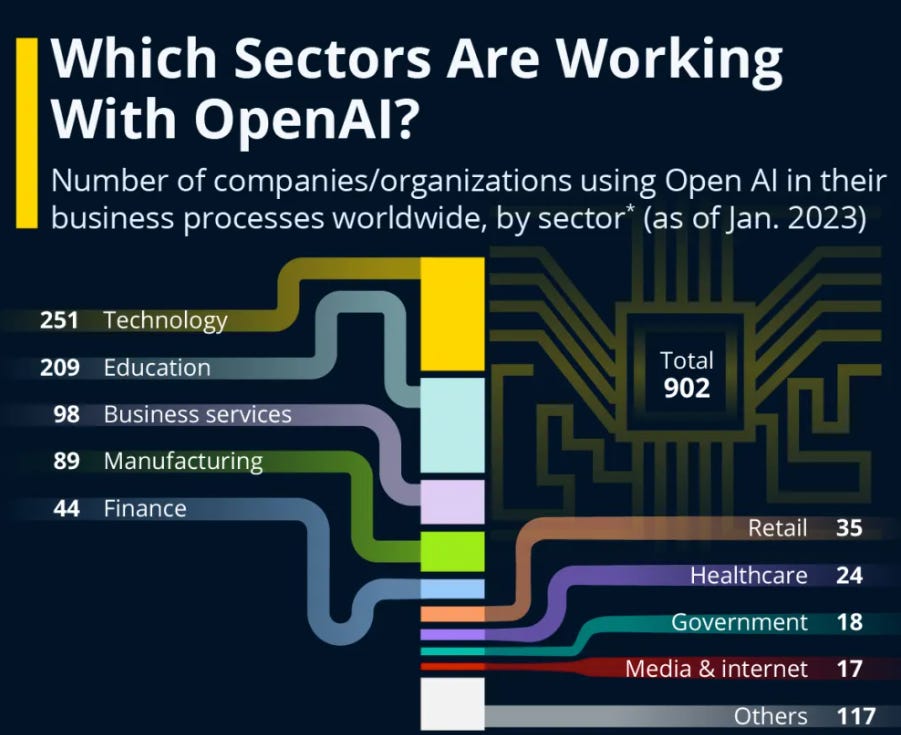

Given the time we’re in, where nearly every business seems to be an AI business, OpenAI is involved directly or indirectly in a wide range of industries, which makes it different from its competitors.

A vision that turns into dollars

Donations also play a crucial role in OpenAI's revenue model. Individuals and organizations who share OpenAI's vision contribute financially to support their research and development efforts. These donations can range from small contributions from individual supporters to substantial amounts from corporate partners who see the potential of AGI in transforming various industries.

On top of that, they have managed to put together a really strong GTM Team that has landed critical partnerships for the company. By collaborating with companies and organizations that align with their mission, OpenAI can secure funding for specific projects or gain access to resources that enhance their research capabilities. These partnerships often involve knowledge sharing, joint research initiatives, or even co-development of AI technologies.

Perhaps the most notable one is with Microsoft, who have committed to give $13bn to OpenAI, as the companies forged an alliance that has put them at the forefront of the AI frenzy. Thanks to their agreement, even though Microsoft has not disclosed sales or user figures for Copilot, the company said in October that 18,000 customers were buying OpenAI software through its Azure platform.

Enterprise customers, which represent a target with deeper spending pockets, will generate more profits based on their computing needs alone. By plugging itself into Microsoft’s existing customer ecosystem, OpenAI can significantly up the distribution of its models, which consequently increases the revenue it generates from licensing fees.

Of course, given their mission, they were initially constrained in finding avenues for generating revenue. That meant they had to prioritize partnerships and collaborations that not only provide financial support but also contribute to the advancement of AGI research. OpenAI is, at least on paper, committed to avoiding any conflicts of interest that may compromise their mission and the safety of AGI.

In terms of revenue, the overwhelming majority that OpenAI generates comes from the licensing fees that it charges to those who use its models or products. Currently, OpenAI monetizes those offerings on a per-unit basis. Pricing for each product can be accessed here.

Every model provides distinct capabilities tailored for specific use cases. Customers can also fine-tune OpenAI’s existing models for which they are charged a fairly larger fee ($0.12 for Davinci on fine-tuned model vs. $0.02 on the standard model).

No shortage of challenges

Any LLM is only as good as the data it’s trained on, and for one that banks on its accuracy, those training models have to be extremely large. That means OpenAI is struggling to bring down those costs, as Altman himself has acknowledged.

On top of that, transitioning from a non-profit organization to a for-profit company, its revenue streams remain limited. A significant percentage of the company’s revenue still comes from donations, which is great when you’re at the forefront of AGI, but doesn’t seem like a solid ground to stand on should things go south.

However, OpenAI has still managed to lower the price of their models in the last few months. These new embedded models have improved abilities at multi-language retrieval and English language tasks. They’re also five times cheaper to use than text-embedding-ada-002, available at a price per 1k tokens of just $0.00002.

To make matters worse, regardless of the potentially lower costs of development, OpenAI still faces a tremendous challenge: Subject Matter Experts. In the age of misinformation, there are plenty of people that can speak on any given topic without even being checked for accuracy.

On the other hand, the biggest company in AI right now cannot afford to get certain things wrong, and they will always be someone willing to call them out if their model makes a mistake.

Of course, this is easy to solve: just train your models better and with more data! Right, but that takes us back to square one: the better you want your models to be trained, the higher their cost will be, which leads us to our conclusion: lowering development costs for OpenAI is a tremendous challenge given that their whole credibility as a company depends on very expensive models being trained with accuracy.

By combining advanced AI research with the practical application of AI, OpenAI has been able to push the boundaries of AI and simultaneously create revenue streams.

OpenAI’s business model has proven to be quite effective, as the company has become a leading player in the AI industry just within few years after its establishment. OpenAI’s strategic partnership with other technology companies has also helped the company access larger resources and provide its AI solutions to more people.